This Might Be My Best Idea for 2022

This is turning into a funny year. Stocks are going down. Interest rates are set to go up. And I’m focused on gold.

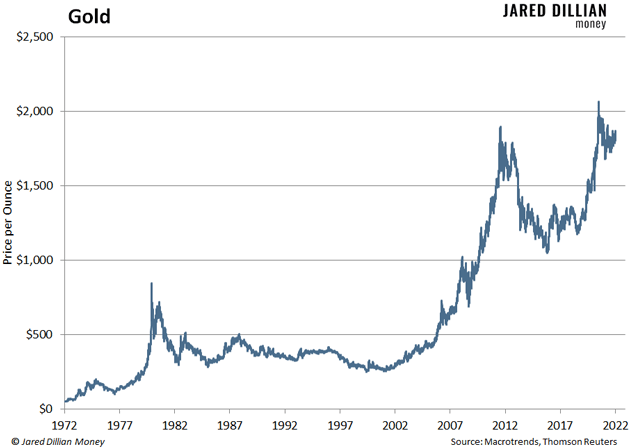

A quick history of gold…

Gold ripped to $678/ounce in 1980. Then it dropped back to $298 in 1985. And by 2011, it had shot up to $1,825—it was a legitimate bubble. Now, here we are at $1,800 and change.

What’s going to happen next? No one knows for sure. But let’s just say I think gold is the best opportunity out there right now. And even if you disagree, you want to own some anyway.

The Rodman of Asset Classes

See, gold is the Dennis Rodman of asset classes. Rodman was inducted into the Hall of Fame in 2011, but the guy barely scored—he only averaged 7 points a game.

But Rodman was phenomenal at defense. His job was to grab the rebound and pass the ball to one of his teammates. And he did that very well, game after game. The NBA calls him “arguably the best rebounding forward in NBA history.”

Still, if you had a team with five Rodmans, it would be terrible. But when you add a Rodman to a team of guys who can score, you’ve got a championship team. That’s what the Chicago Bulls were in the ’90s.

When people look for investments, they look for the Michael Jordans—the players who can score. They don’t look for the player who can rebound and pass the ball. That makes for a volatile situation. Even Jordan didn’t post high scores every night. And when your high scorers all go cold on the same night, you’ve got a problem. Having a Dennis Rodman on your team solves that.

When it comes to investing, there’s nothing wrong with looking for high scorers—the next Netflix (NFLX), the next Amazon (AMZN), etc. But you need to own other assets, too. You need a Rodman—and that means gold.

Make It 20%

For years I’ve said everyone should keep 20% of their portfolio in gold. That sounds like a lot. If you talk to a financial advisor, he’ll say, “No, no. You don’t need gold.” Then he’ll put you in a portfolio of 60% stocks and 40% bonds, or something like that. Well, that guy has it all wrong.

When you add gold to your portfolio, everything gets better. Volatility goes down, which is critical. Because volatility is the enemy of rational decision-making. The more volatile your portfolio, the worse your investment decisions will get. It’s not you—it’s human nature. So, you want to keep volatility to a minimum. Gold will help you do that.

Gold will also lower your overall risk level. And yes, your returns may go down a little bit. But your returns as a function of risk will go up, just by adding a little bit of gold.

Even the people who understand this might only recommend allocating 5%–10% of your portfolio to gold. I say 20%, which is what we have in the Awesome Portfolio.

There are a few ways to do this. First, you could buy physical gold and tuck it away in a home safe. But that can be a nuisance. And the possibility of theft or government seizure is not zero.

For most people, the best option is to invest in gold through a gold ETF, like the one I recommend in The Awesome Portfolio. I’ve included the ticker symbol inside this special report, along with four other specific investment recommendations... and step-by-step guidance on putting them together into a low-volatility, low-risk portfolio that still provides solid long-term gains. Click here for more.

Jared Dillian

|

A Quick Guide to Opening Your First Investment Account

If you’re unsure if your employer sponsors a 401(k) plan… pick up the phone, call your HR department, and ask. Do not run to Chipotle first. This is far more important.

Diversification Is No Defense Against a Bear Market

Investors are all gorked up on crypto. But the problem with that isn’t crypto. The problem is poor portfolio construction.

Saving for Retirement Isn’t That Complicated

Saving for retirement can feel overwhelming. But all it takes is $17 a day and a little attention to where your money goes—no austerity required.

‹ First < 22 23 24 25 26 > Last ›